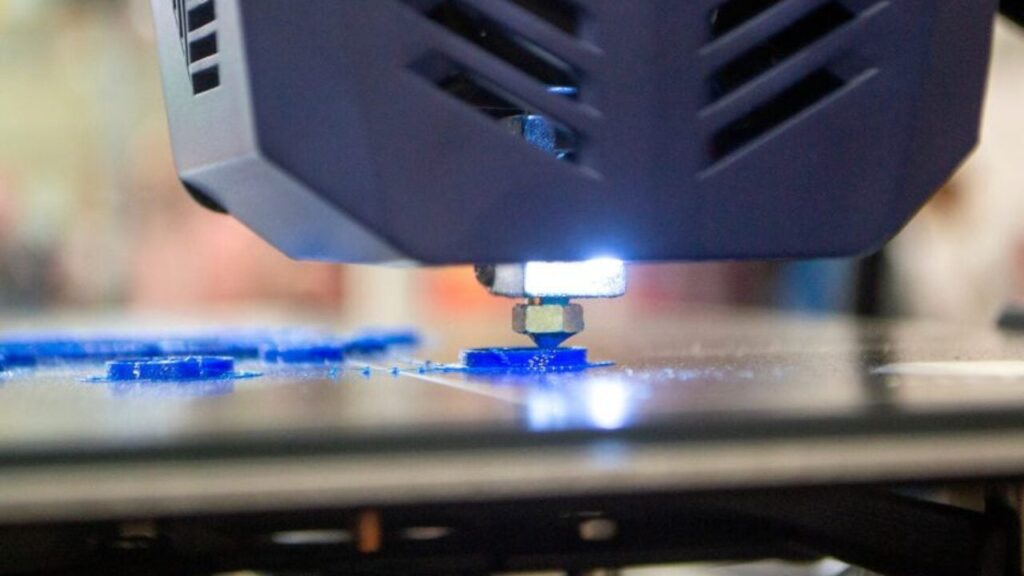

The business production sector is about to undergo a seismic change as 3D printing, also referred to as additive manufacturing (AM), goes from prototyping to becoming a mainstay of production, fueled by high-value materials, AI integration, and sustainability.

India’s USD 3.5 trillion economy and a ₹30,000 crore-sized printing sector are ready to take advantage of this shift, with the global 3D printing market expected to rise from USD 29.29 billion in 2025 to USD 134.58 billion by 2034 at a CAGR of 23.4%, according to a 2025 Fortune Business Insights report 18.52%.

India’s USD 3.5 trillion economy, with a ₹30,000 crore print industry, is already poised to make the most of this shift, since the global 3D printing market is expected to grow to USD 134.58 billion by 2034 at a CAGR of 18.52%, as per a report by Precedence Research in 2025.

But India’s MSMEs struggle with regulatory challenges and talent deficits that may hinder scaling a USD 5 billion domestic print business by 2030.

Top Trends Impacting 3D Printing in Commercial Production:

Industrial and Market Adoption: The industrial 3D printing market, which reached 77% of the revenue in 2024, leads with applications in aerospace, automotive, and healthcare, according to a 2025 Precedence Research report. Aerospace behemoths Boeing utilize AM for weight-saving interior airplane components, and NASA applies it to rocket engines, according to a 2025 Fortune Business Insights report.

In India, collaborations such as ABB Robotics and Simpliforge Creations in January 2024 increase 3D printing for construction, according to a 2024 MarketsandMarkets report.

Material Innovation: Novel materials, such as high-performance polymers, metal alloys, and biocompatible material, are broadening AM uses. In November 2022, Inkbit launched Titan Tough Epoxy 85 elastomer for parts of high accuracy, as per a 2024 Mordor Intelligence report. Carbon fiber is used in parts of racing cars and graphene for medical implants. India’s MSMEs, contributing 40% of print inputs, are supported by the ₹50,000 crore PLI scheme, generating 30% of industry output, according to a 2024 CII report.

AI and Automation: AI maximizes design, material choice, and fault detection, with Interspectral’s AM Explorer software avoiding print defects, as utilized by GKN Aerospace in Sweden, according to a June 2025 X post. Protolabs cites AI-based in-process monitoring enhancing quality control, with commercial products to come soon, according to a 2024 Proto Labs report. India’s Skill India initiative, training 2 million employees, lags with only 5% skilled in AM technology, according to a 2024 Nasscom report.

Large-Format 3D Printing: Large-format AM is breaking size barriers, producing massive components for construction and aerospace. U.S. firms like ICON print 1,600-square-foot homes in under 48 hours, per a 2025 3d Actions report. Verustruct, a Yale startup, develops wall-printing systems with integrated plumbing, per a June 2025 X post. In India, this trend aligns with PM Gati Shakti’s infrastructure push, cutting logistics costs by 20%, per a 2024 CII report.

Sustainability and Decentralized Manufacturing: AM minimizes waste and emissions by production closer to customers. Recycling PLA and PETG filaments are gaining popularity, according to a 2023 Proto Labs report. Decentralized manufacturing is facilitated by cloud platforms, reducing transport costs, according to a 2025 3d Actions report. India’s ONDC increases MSME access to markets by 25%, but there are only 15% enrolled, according to a 2024 SIDBI report.

Defense and Strategic Uses: The U.S. Army utilizes Ingersoll Machine Tools’ factory-in-a-box for bespoke 3D-printed components, according to a June 2025 X post. DARPA’s SURGE program expedites defense component qualification, according to a June 2025 X post. Aerospace and defense uses spur the adoption of AM in India, backed by government R&D spending, according to a 2024 Allied Market Research report.

Challenges and Opportunities in India

India is held back by AM’s promise despite it. 4-6 years vs 2 years for new material regulatory clearances in India vs China, slowing innovation, according to a 2024 Nasscom report. MSMEs have ₹1-2 lakh compliance charges per month, capping scalability. Infrastructure lacunae such as unreliable power disrupt 20% of units.

Volatility in global supply chains, impacting 30% of India’s AM material imports, puts additional pressure, according to a 2024 UNCTAD report. Low adoption of ONDC and skill shortages in Tier 2 cities also hold growth back.

Experts suggest remedies: Technology Upgradation Scheme subsidies, increased Skill India AM training, improved 5G and power reliability through PM Gati Shakti, and public-private partnerships with IITs for material R&D. CII-driven efforts can increase ONDC adoption and awareness of sustainability.

3D printing is revolutionizing commercial manufacturing, with innovations in materials, AI, and large-format printing driving efficiency and customization.

For India, aligning with these trends can elevate its ecosystem, supporting a Viksit Bharat by 2030, provided it overcomes regulatory, skill, and infrastructure barriers.