Global Market on the Rise The global paints and coatings market is set to experience significant growth over the next decade, driven by increasing industrialization, urbanization, and technological advancements. Experts project that the market, valued at USD 193.91 billion in 2025, will reach approximately USD 282.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.27%.

Asia Pacific Leading the Charge Asia Pacific remains the largest regional market, surpassing USD 74.36 billion in 2024 and growing at a CAGR of 4.40%. Europe follows closely, holding over 28% of the global revenue share in 2023. The architectural and decorative segment dominates the industry, accounting for more than 60% of the total market share in 2024.

Key Growth Drivers The market’s expansion is primarily fueled by several critical factors. The booming construction industry plays an essential role in infrastructure and residential construction projects.

Government investments in public infrastructure further drive demand. Growing automotive production also contributes, as the global automobile sector’s increasing need for high-performance coatings is propelling market growth. Environmental regulations and sustainability trends are influencing the market, with stricter policies boosting the demand for eco-friendly, waterborne, and low-VOC coatings. Companies are investing in bio-based technologies to reduce their carbon footprints.

Additionally, advancements in technology, including artificial intelligence (AI) and machine learning, are enhancing R&D and production, leading to improved product adhesion and durability. Smart coatings with self-healing and anti-corrosion properties are gaining traction.

Regional Market Insights Market performance varies across regions, with Asia Pacific continuing to dominate due to rapid construction and automobile production in China, India, and Southeast Asia. Europe benefits from government incentives supporting construction activities, while North America experiences steady growth driven by technological advancements in coatings and increased industrial applications.

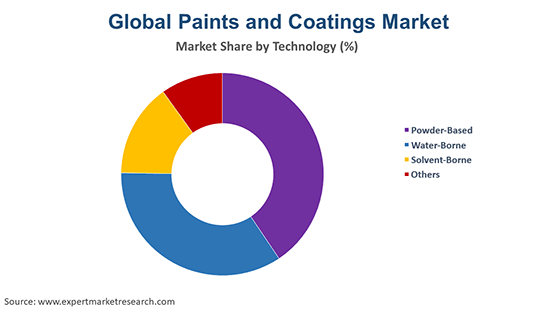

Diverse Market Segmentation The market is categorized based on product, material, and application. By product, waterborne coatings led the market in 2024, holding a 39.4% share due to their eco-friendly nature and quick-drying properties. By material, acrylic coatings dominated in 2023 with over 45% market share, while polyurethane coatings are projected to grow at a CAGR of 5.8%. By application, the architectural and decorative segment remains the largest, followed by industrial and automotive applications.

Industry Leaders and Developments Major players in the market include Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Jotun A/S, Axalta Coating Systems, LLC, RPM International Inc., Kansai Paint Co., Ltd., and BASF SE. Recent industry developments highlight the market’s dynamism. In December 2024, LIC increased its stake in Asian Paints to 7% through open-market acquisitions. In February 2024, Grasim Industries entered the decorative paints sector with an INR 10,000 crore investment.

Supply Chain Challenges and Opportunities The paints and coatings industry relies on a complex value chain, involving raw material suppliers, manufacturers, distributors, and end users. Key raw materials such as pigments, resins, solvents, and additives are primarily derived from oil and natural gas feedstocks. Price volatility in crude oil impacts raw material costs, affecting overall market dynamics.

Future Outlook Despite challenges such as fluctuating raw material prices, the global paints and coatings market is expected to thrive over the next decade. Urbanization, industrial expansion, and sustainability-driven innovations are set to drive long-term growth. With strong investments and increasing demand across multiple sectors, the industry is on a promising trajectory for sustained success.