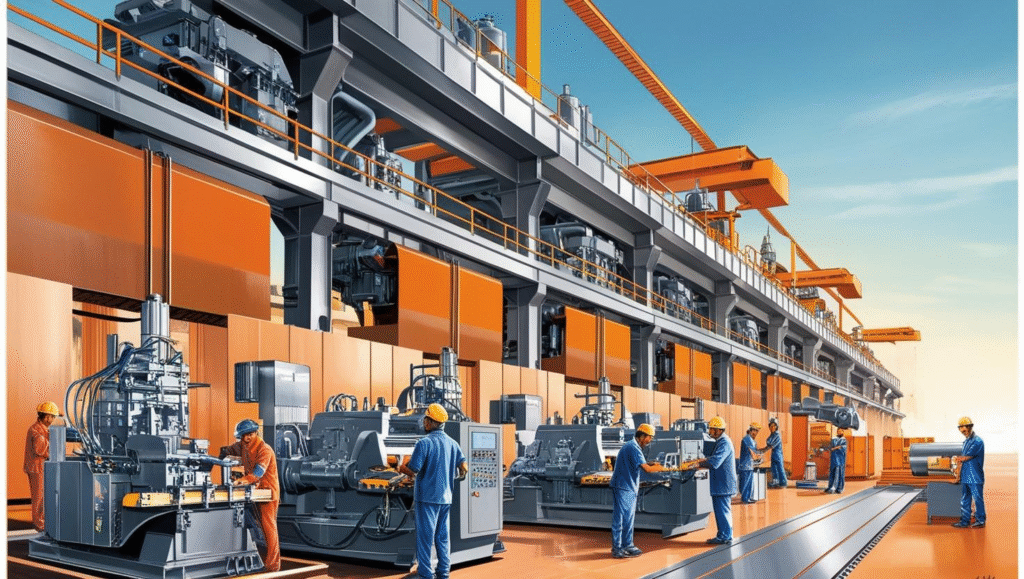

India’s heavy engineering industry, generating INR 2,00,000 crore every year and 3.53% of GDP, is waiting in the wings for international expansion as overseas markets race for its cost-effective, high-quality equipment.

As engineering exports touched USD 109.32 billion in FY24, heavy engineering—capital goods, transport equipment, and industrial machinery—holds immense opportunities in USA, UAE, and Southeast Asia markets, as per EEPC India.

Low cost of manufacturing and expertise are India’s competitive advantage.

Larsen & Toubro (L&T) with an investment of USD 500 million in intelligent machinery serves petrochemical and defense industries, exporting to the USA, which imported USD 17.63 billion of Indian engineering goods in FY24.

BHEL’s nuclear equipment and ISGEC’s boilers are compliant with global standards, riding UAE’s infrastructure boom. The USA, UAE, and Saudi Arabia were leading importers during FY25 (Apr-Dec), with industrial machinery such as IC engines and valves being in high demand.

Government policies drive this expansion. Duty exemptions and the Zero Duty EPCG scheme facilitate raw material imports, while the PLI scheme for auto components stimulates EV machinery exports.

The International Engineering Sourcing Show (IESS) of EEPC India links exporters to markets such as Africa, where Nigeria imports Indian construction machinery. The ‘Make in India’ initiative and 100% FDI through automatic routes draw companies like Cummins, raising export potential.

The emerging markets hold unexplored possibilities. Southeast Asia’s infrastructure schemes, such as Indonesia’s USD 33 billion capital city shift, require India’s earthmoving equipment.

Africa’s agricultural drive is in quest of dairy and food processing machinery, with the exports set to rise 11.5% a year, according to WTO. India’s FTAs, such as CEPA with UAE, facilitate customs clearance, increasing exports during festivals such as Eid.

Challenges are a 30% gap in skills for cutting-edge tech such as IoT, according to Nasscom, and bureaucratic hurdles in such markets as Germany. MSMEs, which form the backbone of the industry, suffer from financing woes, with 70% being unable to pay for automation.

The Digital MSME Scheme provides 50% subsidy, while Skill India certifies 10,000 workers every month.

Exporters are able to use EEPC’s market intelligence to overcome compliance, as observed in Gujarat’s chemical machinery clusters.

With exports targeted at USD 200 billion in 2030, heavy engineering is India’s export dynamo. “Our machinery is world-class,” opined Priya Menon, a CII analyst. “Global markets are ours to conquer.”