General Motors (GM) and LG Energy Solution are leading a revolution in electric vehicle (EV) technology with the introduction of lithium manganese-rich (LMR) prismatic battery cells, which will propel its electric trucks and SUVs by 2028.

The new batteries deliver more than 400 miles of range, lowered costs, and increased sustainability, positioning GM to take the EV lead while allaying consumers’ range anxiety and affordability concerns.

Albeit with potential, there are still challenges to scaling production and delivering long-term durability, especially for India’s nascent EV ecosystem.

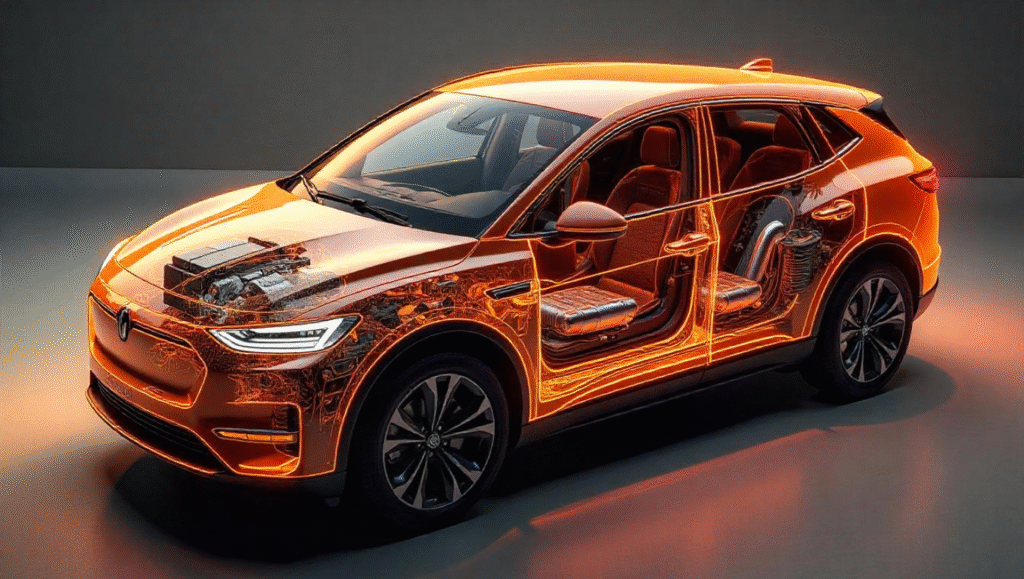

The LMR batteries, studied by GM since 2015, are based on a 65% manganese, 35% nickel cathode chemistry with almost no cobalt, an expensive and ethically complicated mineral. This design cuts the cost of materials, with manganese being plentiful and less expensive than nickel or cobalt, and could bring battery cost down to $80–$90 per kWh from $125 per kWh for GM’s current nickel-manganese-cobalt-aluminum (NMCA) batteries, according to industry estimates.

The prismatic cell structure, in contrast to GM’s Ultium platform pouch cells, cuts the number of battery module components 75% and overall pack components 50%, reducing weight by hundreds of pounds while making manufacturing easier.

The energy density of LMR cells is a game-changer, offering 33% higher density than lithium iron phosphate (LFP) batteries at a comparable cost, enabling ranges exceeding 400 miles, compared to the 492-mile Chevrolet Silverado EV Work Truck’s current NMCA pack. “We’re pioneering manganese-rich battery technology to unlock premium range and performance at an affordable cost, especially in electric trucks,” said Kurt Kelty, GM’s VP of Battery, Propulsion, and Sustainability.

GM’s Wallace Battery Cell Innovation Center has developed 300 large-format LMR cells, tested more than 1.4 million miles of simulated driving, and overcame past shortcomings such as voltage sag and short life with proprietary dopants, coatings, and particle engineering.

India’s EV market, set to grow to USD 7.09 billion by 2025 at a 36.7% CAGR, can look to benefit from such advancements.

With 1.3% of the vehicles being electrified and 12,146 charging points as of 2024, according to a FICCI report, long-range affordable batteries could hasten adoption.

Manufacturers such as Tata Motors and Mahindra, concentrating on EVs such as the Nexon EV and XUV400, might consider developing LMR technology to rival the rest of the world, given India’s manganese deposits, which stand at fifth position globally at 52 million tonnes, according to a 2024 USGS report.

Government initiatives like the Production-Linked Incentive (PLI) scheme, allocating Rs. 18,100 crore for battery manufacturing, and PM Gati Shakti’s logistics enhancements support local production.

Indian consumers, confronting high initial costs of EVs (30–40% of them related to the battery), look for similar cost cuts to price models such as the MG ZS EV more affordably.

Challenges still abound. LRM production scaling by 2028 will involve substantial investment in Ohio and Tennessee’s GM Ultium Cells factories, with pre-production commencing at LG’s factory in late 2027.

Previous LMR efforts experienced capacity fade, and although this is said to have been addressed by GM, road-durability is yet to be proven. In India, MSMEs, which manufacture 30% of EV parts, are hampered by adoption due to the high cost of R&D (Rs. 1–2 crore/year, according to a 2024 SIDBI report) and lack of skills, with merely 5% of Skill India’s 2 million trained employees with expertise in cutting-edge battery tech, according to Nasscom. Infrastructure problems, such as fluctuating power supply in Tier 2 cities, also add to manufacturing complexities.

Competition is intense in the global market. Ford’s strategy for LMR adoption is by 2030, whereas Tesla’s previous manganese-abundant battery drive has not materialized. China dominates LFP batteries with 70% of global lithium-ion production, according to a 2024 Bloomberg report, which presents a challenge.

India’s battery industry, dependent on imported lithium, needs to localize supply chains in order to benefit from LMR’s cost advantage, coinciding with the National Mission on Transformative Mobility’s 30% penetration of EVs by 2030.

Experts provide solutions. Subsidies of the Technology Upgradation Scheme can reduce MSME expenses. Scaling up Skill India’s training in battery-related training can fill skill gaps. Public-private partnerships with IITs and international companies such as LG can upscale R&D. CII-organized campaigns can increase awareness, generating demand. Scaling up 5G and power reliability under PM Gati Shakti will enable production.

GM’s LMR batteries with their potential for more than 400 miles of range and reduced expense may alter EV affordability and accessibility. For India, embracing such technologies could trigger its EV revolution, capitalizing on local resources and government incentives.

Through surmounting manufacturing and infrastructure constraints, GM and Indian auto producers can propel a sustainable, long-range future for electric mobility.