Amid India’s USD 3.5 trillion economic ascent, a transformative shift is brewing in the electric vehicle (EV) and energy storage sectors: the rise of solid-state electrolytes, with sulfide-based materials at the forefront.

Poised to replace flammable liquid electrolytes in lithium-ion batteries, these materials promise safer, denser, and longer-lasting batteries. The global solid-state battery market, valued at USD 1.2 billion in 2024, is forecast to reach USD 7.8 billion by 2032 at a 26.4% CAGR, per a 2025 Fortune Business Insights report. In India’s ₹25,000 crore battery industry, sulfide-based electrolytes could drive EV adoption, but scaling to commercial production faces hurdles in cost, stability, and skills, challenging MSMEs eyeing a USD 2 billion domestic market by 2030.

Solid-state electrolytes, unlike liquid counterparts, use solid materials like sulfides, oxides, or polymers to conduct lithium ions, slashing fire risks by 90% and boosting energy density by 30%, per a 2024 Nature Energy study. Sulfide-based electrolytes, such as lithium thiophosphate (Li3PS4), stand out for their high ionic conductivity—up to 10^-2 S/cm—rivaling liquid electrolytes, and flexibility, easing integration into battery designs, per a 2024 Journal of Power Sources report. They enable fast charging, cutting EV charge times to 15 minutes, and extend battery life by 20%, per a 2025 ACS Energy Letters study. India’s EV market, growing at a 45% CAGR, demands such advancements to meet 30% electrification targets by 2030, per a 2024 NITI Aayog report.

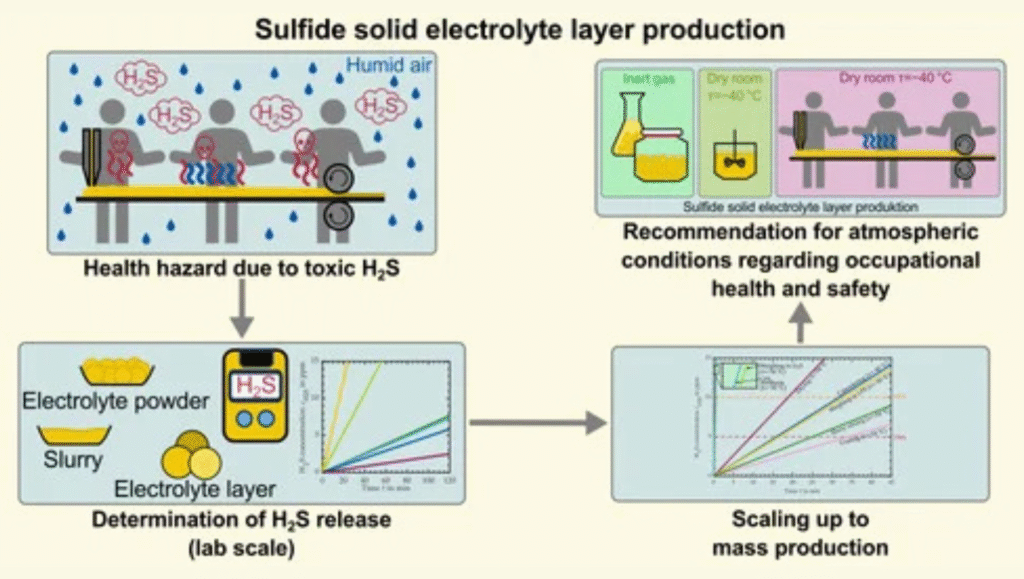

Recent breakthroughs signal commercial potential. Wet synthesis methods for Li6PS5Cl reduce production costs by 25% compared to vacuum-based processes, per a 2024 ACS Applied Materials study. Protective coatings, like lithium fluoride, mitigate sulfide sensitivity to air and moisture, improving stability and manufacturability, per a 2025 ScienceDirect report. Companies like Toyota and Samsung SDI have piloted sulfide-based cells, achieving 500 Wh/kg energy density, double that of conventional batteries, per a 2025 Nikkei Asia report. Yet, challenges persist: sulfide electrolytes cost USD 100/kg versus USD 10/kg for liquid electrolytes, and dendrite formation risks short circuits, per a 2024 Electrochemical Society Journal study.

In India, Amara Raja and Log9 Materials are exploring sulfide electrolytes, while global leaders—Solid Power, QuantumScape, and LG Chem—set benchmarks, per a 2025 Business Standard report. MSMEs, contributing 20% to battery inputs, leverage the ₹50,000 crore PLI scheme and ONDC, boosting market access by 20%, per a 2024 SIDBI report. The sector supports 250,000 jobs and could save USD 2 billion annually by reducing cobalt and nickel imports, aligning with Make in India, per a 2024 UNCTAD report. However, India imports 80% of advanced electrolyte materials from China and Japan, constrained by limited R&D, per a 2025 Economic Times report.

Scaling faces obstacles. Regulatory approvals take 4–6 years versus China’s 2, and MSMEs face ₹1–2 lakh monthly compliance costs, per a 2024 Nasscom report. Only 5% of Skill India’s 2 million workers are trained in solid-state tech, and ONDC adoption lags at 15%. Power disruptions affect 20% of units, hampering production. Experts recommend Technology Upgradation Scheme subsidies, Skill India training, PM Gati Shakti’s 5G enhancements, and IIT partnerships, per a 2025 LatestLY report. CII campaigns could drive awareness and ONDC uptake.

Sulfide-based solid-state electrolytes hold immense promise for India’s EV future. Overcoming cost, stability, and skill barriers will unlock commercial-scale production, bolstering GDP and a Viksit Bharat by 2030.