In the wake of India’s USD 3.5 trillion economy navigating a health-conscious era, antiviral surface sprays are redefining hygiene in post-pandemic homes, promising long-lasting protection against pathogens.

With the global antimicrobial coatings market valued at USD 12.4 billion in 2024 and projected to reach USD 22.8 billion by 2032 at a 7.9% CAGR, per a 2025 Allied Market Research report, India’s ₹15,000 crore surface care industry is witnessing a surge in demand for these sprays.

Claiming to neutralize viruses for weeks or months, these products hinge on advanced chemistry, but scientific scrutiny raises questions about their durability. Regulatory gaps and skill shortages challenge MSMEs targeting a USD 1 billion domestic market by 2030.

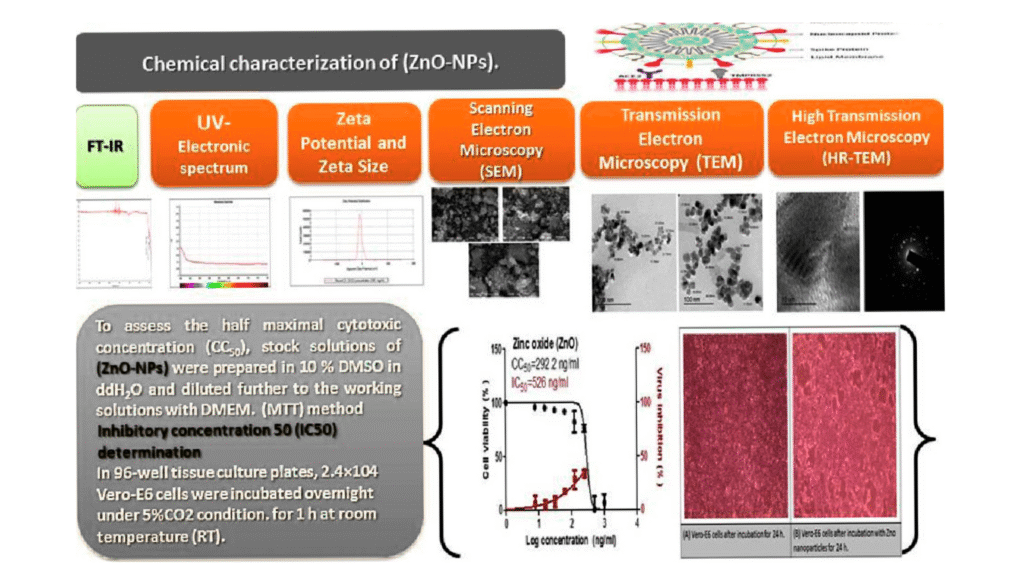

Antiviral surface sprays, infused with active agents like quaternary ammonium compounds, silver nanoparticles, or titanium dioxide, form protective coatings on high-touch surfaces like doorknobs, countertops, and furniture, reducing viral viability by up to 99.9% within hours, per a 2024 Journal of Applied Microbiology study.

Unlike traditional disinfectants requiring frequent reapplication, these sprays leverage microencapsulation and photocatalytic technologies to extend efficacy, with some brands claiming protection for up to 90 days, per a 2024 ACS Applied Materials report.

India’s urban households, with 70% adopting advanced hygiene products post-COVID, drive this trend, per a 2025 NielsenIQ report.

Scientific evidence, however, paints a mixed picture. Lab tests show silver-based sprays maintain 90% efficacy against coronaviruses for 30 days under controlled conditions, per a 2024 ScienceDirect study. Yet, real-world factors like abrasion, cleaning, and UV exposure reduce durability to 7–14 days, per a 2025 MDPI report.

Photocatalytic sprays, activated by light, degrade organic matter but struggle with consistent performance in low-light environments, per a 2024 Journal of Photochemistry study.

Long-lasting claims often lack peer-reviewed field data, and high costs—USD 50 per liter versus USD 5 for conventional disinfectants—limit mass adoption, per a 2025 Economic Times report.

Indian companies like Pidilite (Dr. Fixit) and Asian Paints are innovating with nano-silver and zinc-based sprays, while global leaders—3M, BASF, and Nippon Paint—set benchmarks with durable formulations, per a 2025 Business Standard report. MSMEs, supplying 30% of products, benefit from the ₹50,000 crore PLI scheme and ONDC, boosting market access by 20%, per a 2024 SIDBI report.

The sector supports 200,000 jobs and reduces import reliance on active ingredients by 15%, aligning with Make in India, per a 2024 UNCTAD report. However, India imports 60% of high-performance antiviral agents from China and Germany due to limited R&D, per a 2025 Hindustan Times report.

Challenges abound. Regulatory approvals take 4–6 years versus China’s 2, delaying innovation, per a 2024 Nasscom report. MSMEs face ₹1–2 lakh monthly compliance costs, and power disruptions affect 20% of units.

Only 5% of Skill India’s 2 million workers are trained in antiviral coating tech, and ONDC adoption lags at 15%, per a 2024 Nasscom report. Experts recommend Technology Upgradation Scheme subsidies, Skill India training, PM Gati Shakti’s 5G enhancements, and IIT collaborations, per a 2025 LatestLY report. CII campaigns could drive awareness and ONDC uptake.

Antiviral surface sprays offer a promising shield for India’s homes, but science tempers their long-lasting claims. Scaling local innovation and robust testing will ensure efficacy, drive GDP, and support a Viksit Bharat by 2030.