With India’s electric vehicle (EV) industry surging, set to reach 17 million units a year by 2030, the world of adhesives is changing to address EV manufacturing’s distinctive needs.

With heat resistance, lightweighting, crash toughness, and sustainability requirements, adhesives play an essential role in bonding disparate materials and maintaining EV performance.

Spurred by government incentives and worldwide transition to green mobility, Indian adhesives makers are leapfrogging to address these issues but risk being derailed by cost and technological barriers.

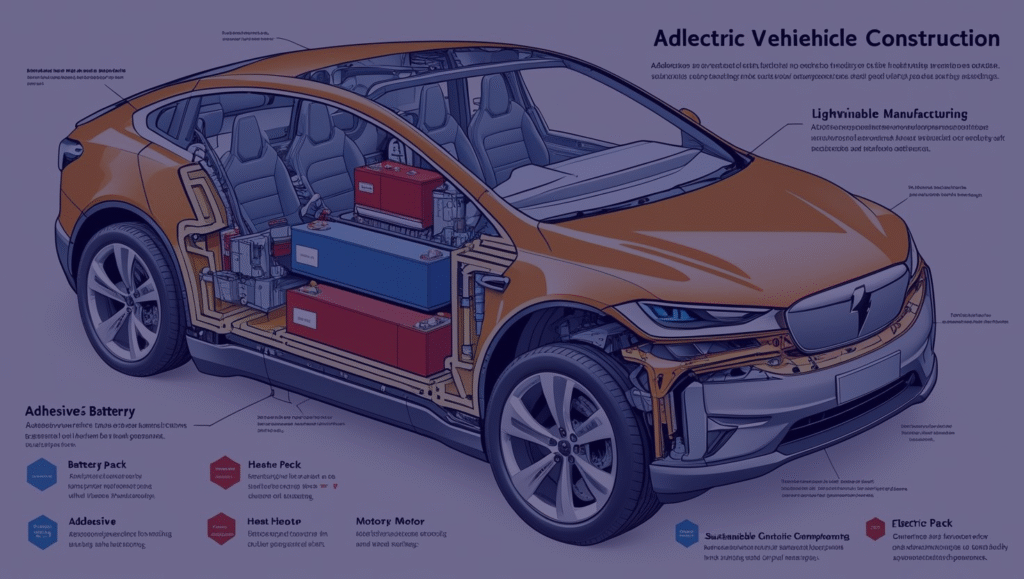

The EV boom is redefining the need for adhesives. In contrast to conventional vehicles, EVs are dependent on adhesives for structural integrity, thermal management, and lightweighting.

Since 70% of an EV’s weight is comprised of batteries and lightweight components such as aluminum and composites, adhesives take the place of welds and bolts to join disparate substrates, decreasing vehicle weight by as much as 15%, according to a 2024 study by the Automotive Research Association of India (ARAI).

India’s EV manufacturing, which increased by 50% during FY 2023-24, requires adhesives that have high temperature resistance along with meeting sustainability targets under the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme.

Heat resistance is one of the greatest concerns. EV batteries are at temperatures higher than 200°C, and a thermal stable adhesive is essential. Polyurethane and silicone adhesives, applied to battery packs, facilitate heat dissipation and insulation, safeguarding cells from thermal runaway.

Pidilite Industries has formulated thermally conductive polyurethane adhesives for Tata Motors’ EV battery assemblies, retaining performance at 250°C, according to a 2024 industry report.

Epoxy adhesives, used in motor encapsulation, provide high dielectric strength, guaranteeing electrical safety. These developments enable India’s goal of 30% EV penetration by 2030, fueled by initiatives such as Ola Electric’s Tamil Nadu gigafactory.

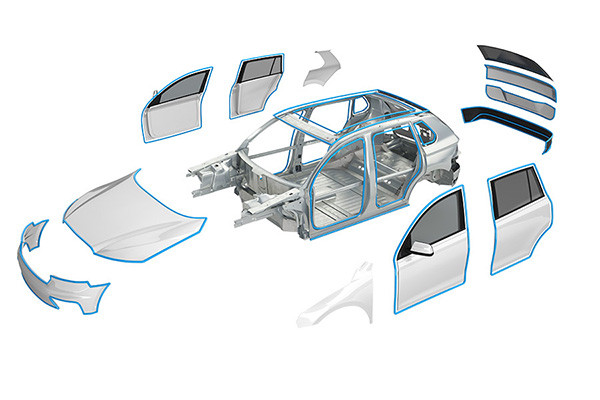

Lightweighting is another key challenge. Adhesives enable the bonding of aluminum, carbon fiber, and plastics, reducing reliance on heavy mechanical fasteners.

Acrylic-based structural adhesives, used in chassis and body panels, provide crash durability, absorbing 20% more impact energy than welds, per a 2023 IIT Madras study. Henkel India’s methyl methacrylate adhesives, adopted by Mahindra Electric, bond dissimilar materials with a shear strength of 25 MPa, supporting lightweight designs without compromising safety.

These innovations are crucial as India’s automotive industry, which manufactured 22.93 million vehicles in FY 2021-22, turns towards EVs.

Sustainability is transforming adhesive formulations. With 60% of Indian consumers giving preference to green products, according to a 2023 Nielsen survey, producers are turning to bio-based adhesives to lower the dependence on petrochemicals.

Soy-based adhesives, formulated by startups such as Specialty Organics, provide low-VOC bonding for interior parts, reducing emissions by 30%.

Lignin adhesives from India’s 20 million-ton pulp sector offer biodegradable solutions for non-structural use, equaling 80% of the tensile strength of phenol-formaldehyde resins, according to a 2024 report. They conform to the National Green Mission’s drive toward green materials.

Government initiatives are speeding it up. The Production-Linked Incentive (PL) scheme with USD 27 billion support encourages R&D in EV adhesives, while the Raising and Accelerating MSME Performance (RAMP) scheme helps small companies, which make 40% of India’s adhesives, go green through the implementation of green technology.

The National Research Foundation (NRF) promotes collaboration between industry and academia, where IITs create nanocellulose-strengthened adhesives for EV battery cases, increasing strength by 15%.

The FAME-II program’s USD 1.4 billion investment in EV infrastructure also increases demand for next-generation adhesives.

Notwithstanding development, there are still issues to be overcome. High-performance adhesives are 20-30% more expensive than traditional ones, placing a burden on MSMEs, with just 12% using EV-specific formulations, according to a 2024 SIDBI report. Lack of skills is a chokepoint—only 5% of workers are trained in nanotechnology or bio-based adhesive applications, according to Nasscom.

Infrastructure problems, such as unstable power supply in Tier 2 towns, hamper production, which costs SMEs Rs. 1-2 lakh per month, according to industry reports.

Delayed regulations, with patent approval taking 4-6 years compared to China’s 2 years, discourage innovation. Competition from ASEAN countries, providing cheaper production costs, increases pressure.

In order to overcome the challenges, specialists suggest strategic interventions.

Subsidies under the Technology Upgradation Scheme can help alleviate the costs for MSMEs. Increased Skill India training in the latest adhesive technologies can fill skill gaps. Enhanced 5G connectivity and power reliability, envisaged under PM Gati Shakti, will aid the production effort. Public-private collaborations, such as ARAI, can expand R&D. Industry associations such as CII can promote awareness of sustainable adhesives in niche markets.

India’s adhesives sector is poised to respond to the EV revolution’s demands, providing heat tolerance, reduced weight, and sustainability solutions. With the auto industry eyeing threefold growth under the Automotive Mission Plan 2016-26, adhesives will be the key driving India’s green mobility wave.

By overcoming the hurdles of cost, skill, and infrastructure, Indian manufacturers can take the lead in the global EV adhesive market, coupling performance with sustainability.