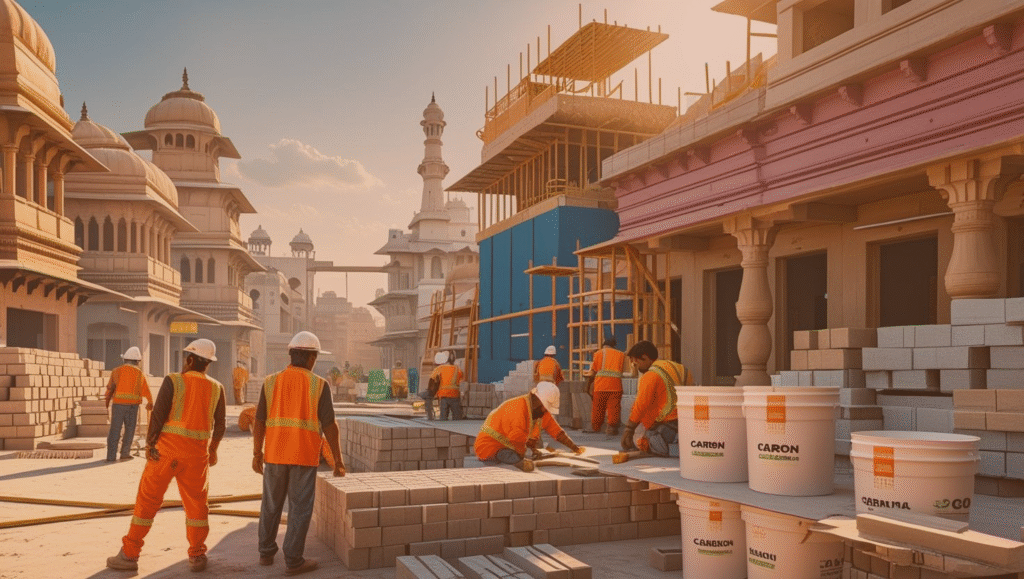

As urban India hurtles towards a USD 1.7 trillion infrastructure market by 2030, fuelled by the Smart Cities Mission and rapidly growing infrastructure projects, the need for green building materials is transforming the sector.

Carbon-zero construction chemicals, especially low-carbon repair and waterproofing solutions, are picking up among developers, providing environmentally friendly alternatives to conventional cement-based solutions.

With India’s construction industry accounting for 12% of national CO2 emissions, these technologies are consistent with net-zero objectives, but cost and awareness hurdles hinder mass adoption.

Carbon-neutral construction chemicals that reduce greenhouse gas emissions both in production and application are pivotal to sustainable urbanization.

Since 70% of the construction requirement is connected with urban projects, such as 100 Smart Cities and the USD 1.8 trillion investment in the National Infrastructure Pipeline, developers are under huge pressure to achieve green building certifications such as LEED and IGBC.

The Bureau of Indian Standards (BIS) and international REACH requirements demand low-VOC and environmentally friendly formulations, while India’s cement sector, churning out 337 million tonnes a year, aims to cut its 7% of the world’s emissions, according to a 2024 FICCI report.

Low-carbon waterproofing products are taking the lead. Bio-based integral waterproofing admixtures, based on lignin from India’s 20 million-tonne pulp sector, lower concrete permeability by 30%, according to a 2023 IIT Delhi research.

These admixtures, adopted by companies like Fosroc India, cut cement usage by 15%, lowering emissions.

Nanocellulose-based waterproofing compounds, developed by startups like EcoCrete Solutions, create hydrophobic barriers, enhancing durability in humid urban climates. Pidilite Industries’ Dr. Fixit GreenShield, used in Mumbai’s smart city projects, reduces maintenance costs by 20% while achieving zero-VOC status, supporting LEED compliance.

Repair solutions are also evolving. Fly ash and slag-based repair mortars, made from industrial waste products, keep 50 million tonnes of waste out of landfills every year, according to a 2024 CII report.

The mortars, applied in Delhi metro expansions, provide 25% greater compressive strength compared to cement-based mortars, adding 10 years to structure lifetimes.

Algae-based repair materials, spearheaded by companies such as GreenBuild Tech, take up CO2 while curing, capturing 8 kg per cubic meter of concrete, keeping in line with the Swachh Bharat Mission. Graphene-reinforced repair sealants, launched by BASF, enhance crack resistance by 30%, minimizing periodic interventions into high-traffic urban infrastructure.

These technologies abet India’s urban sustainability objectives. Low-carbon chemicals decrease the embodied carbon in buildings by 20%, which is vital for Smart Cities’ energy efficiency goals.

In Bengaluru, bio-based waterproofing has reduced cooling energy consumption by 15%, as per a 2024 IGBC report.

Slag-based repair solutions are adopted by infrastructure projects, such as Gujarat’s Gift City, which decreases the cost of construction by 12% and aligns with international ESG standards. 60% of city developers making sustainable materials their top priority, according to a 2023 Nielsen survey, means demand is booming.

Government schemes are driving adoption. The Rs. 50,000 crore spent under the Production-Linked Incentive (PLI) scheme on the National Research Foundation (NRF) incentivizes R&D for green chemicals.

The Raising and Accelerating MSME Performance (RAMP) scheme incentivizes smaller businesses, which make 30% of construction chemicals, to implement low-carbon technologies.

The National Green Mission encourages green construction, while PM Gati Shakti fortifies raw material supply chains. Skill India Digital Hub has certified 2 million workers in green construction since 2023, improving implementation.

There are challenges, nevertheless. Carbon-neutral chemicals are 20-30% more expensive than traditional ones, discouraging MSMEs, where only 10% use them, according to a 2024 SIDBI report. Performance issues, such as slower curing times within bio-based admixtures, delay projects in humid climates.

Skill deficits, with only 5% of the workforce skilled in green chemistry, according to Nasscom, constrain innovation. Infrastructural problems, such as fluctuating power supply in Tier 2 cities, are halting production, running SMEs Rs. 1-2 lakh a month, according to industry reports. Low awareness among small developers, cost sensitivity at the expense of sustainability, is holding back adoption.

Experts suggest focussed action. Subsidies under the Technology Upgradation Scheme can help ease the cost. Scaling up Skill India’s training in green chemistry can fill skill gaps. Enhancing 5G connectivity and power reliability, as proposed under PM Gati Shakti, will aid production.

Public-private partnerships with IITs can ramp up R&D for affordable solutions. CII-led awareness campaigns can increase demand among smaller developers, promoting inclusive growth.

India’s city infrastructure is adopting carbon-neutral building chemicals, transcending cement to achieve net-zero targets. With a USD 1.7 trillion market expected, low-carbon waterproofing and repairing solutions are central to resilient, green cities.

Overcoming cost, skill, and awareness hurdles, Indian producers can spearhead the world’s transition to green construction, constructing a carbon-neutral future for India’s urban centers.