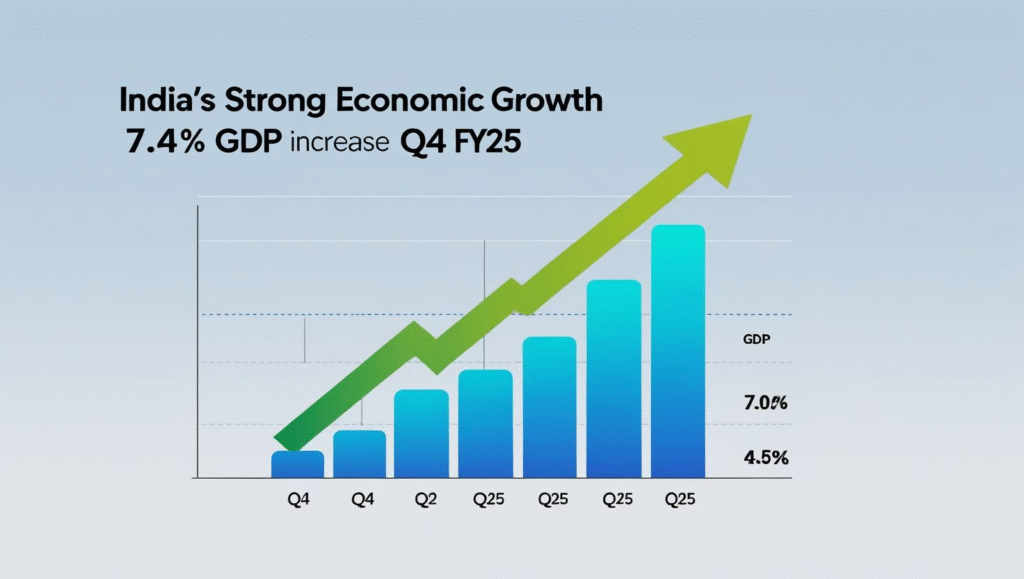

India’s economy grew a strong 7.4% during the January-March quarter of FY25, better than estimates and solidifying its reputation as the world’s fastest-growing major economy, as per data announced by the National Statistics Office (NSO) on May 30.

The strong growth, led by agriculture and construction, took the full-year FY25 growth to 6.5%, even though it was a four-year low from the 9.2% in FY24.

The Q4 FY25 growth of 7.4% surpassed the Bloomberg consensus estimate of 6.8% and showed strength in the face of worldwide uncertainties. Chief Economic Adviser V. Anantha Nageswaran said the performance was because of strong domestic demand, with private consumption at a record share since FY04.

The government keeps FY26 growth forecast at 6.3-6.8%, with private consumption, particularly rural rebound, and sticky services exports as major drivers.

Major industries were in the spotlight. Farming expanded by 5.4% on account of good monsoon rains, and building recorded a 10.8% growth, led by infrastructure spending. Services, which have contributed more than 50% to GDP, also recorded moderate growth of 7.3%. Manufacturing trailed at 4.5%, courtesy of global trade dislocations and softer urban demand.

On the spending side, Gross Fixed Capital Formation (GFCF) increased by 9.4%, which boded well for investment momentum, especially on the part of private capital. Private consumption expanded 6%, a decline from 8.1% in the previous quarter, with urban expenditure weakening, while rural demand for durables and agricultural equipment picked up.

Government expenditure shrank by 1.8%, a decline from the 9.3% growth in Q3, as fiscal consolidation practices became effective.

Net exports became positive, led by a 7.3% increase in services exports, according to Sujan Hajra, Chief Economist, Anand Rathi Group.

While the Q4 increase, however, still saw the full-year expansion of 6.5% matching the NSO’s second advance estimate, lower than 9.2% during FY24. Economists pointed out that global headwinds such as geopolitical tensions and trade uncertainties tempered the year-earlier figure.

“India’s GDP at 6.5% indicates core strength, fueled by strong domestic demand and consistent services exports,” Deutsche Bank’s Kaushik Das said. Deloitte’s Ranjan Kumar further pointed out that tax incentives under the Union Budget 2024 would add 0.4-0.7% to GDP in FY26, although tariff uncertainties with the U.S. would clip off 0.1-0.3%.

India’s FY25 nominal GDP stood at ₹33.1 lakh crore (US$3.84 trillion), 9.8% higher than FY24’s ₹30.07 lakh crore, further cementing its path to surpassing Japan as the fourth-largest economy by FY26, according to IMF estimates. India’s FY25 fiscal deficit is pegged at 4.8% of GDP, facilitated by prudent government expenditure.

In the future, authorities are optimistically guarded. DK Joshi of Crisil forecasts a 6.5% expansion for FY26 based on rural consumption and robust agriculture, but possible downsides are global slowdowns and weakness in manufacturing.

A good monsoon, softening inflation (3.2% CPI in April), and possible RBI interest rate reductions of 50-70 basis points by mid-2025 can additionally accelerate consumption. Export uncertainty and urban consumption fatigue need to be watched closely, though.

India’s 7.4% Q4 growth highlights its economic momentum, even if the annual figure was moderated.

With structural reforms, the boost in rural demand, and judicious fiscal policies, the country is all set to continue its growth path, embracing challenges from around the world while affirming its economic weight.