India’s financial markets witnessed the epochal moment when the nation’s first mortgage-backed Pass-Through Certificates (PTCs) were listed on the National Stock Exchange (NSE) on May 5, 2025.

Billed by RMBS Development Company Limited and secured by housing loans of LIC Housing Finance Limited, the ₹1,000 crore issue consisting of 1,00,000 certificates at ₹1,00,000 each was subscribed to in full, showcasing investor confidence.

This trailblazing move, at a coupon rate of 7.26% per annum to be determined through NSE’s Electronic Book Provider (EBP) platform, fortifies India’s USD 3.5 trillion economy by furthering its securitization and housing finance markets.

Yet, despite this milestone, measures such as MSME access to capital markets and regulatory complexities may deter more extensive take-up, highlighting the imperative for continued reforms to unlock a USD 3 billion securitization market by 2030.

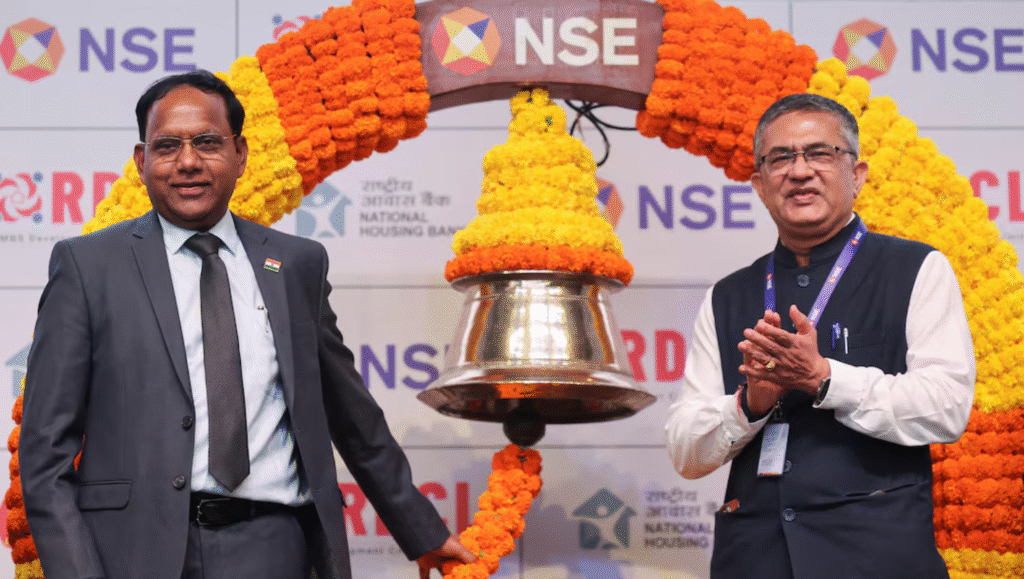

The launch, conducted by M. Nagaraju, Secretary to the Department of Financial Services (DFS), Ministry of Finance, at a ceremonial bell-ringing ceremony, coincides with the government’s affordable housing initiative under the Pradhan Mantri Awas Yojana (PMAY).

Nagaraju pointed out the importance of housing to economic development, citing its connectivity to infrastructure and supporting industries, which generate 15% of GDP, according to a 2024 CII report. “Securitization under PTCs connects housing finance institutions and debt capital markets, augmenting liquidity,” he added, according to a 2025 PIB release.

The PTCs, rated AAA(SO) by CRISIL and CARE, come with a 20-year tenor and are marketable in dematerialized format, increasing market depth, according to a 2025 Hindustan Times report.

This historic issue, the first to utilize NSE’s EBP platform for coupon rate discovery, reduces pricing transparency and investor access. The 7.26% coupon indicates high demand for long-term asset-backed securities, with institutional buyers such as banks and mutual funds driving subscription, according to a 2025 Business Today report.

Securitization, which bundles housing loans into tradable bonds, releases capital for lenders such as LIC Housing Finance, allowing ₹1.5 trillion in fresh loans each year, according to a 2024 FICCI report. This compliments India’s 100% housing coverage target by 2030, leaving 30% of urban demand unsatisfied, according to a 2024 MoHUA report.

Government schemes have multiplier effects. The ₹50,000 crore Production-Linked Incentive (PLI) programme aids MSMEs in construction, accounting for 30% of housing inputs. PM Gati Shakti reduces logistics costs by 20%, benefiting infrastructure growth. The Open Network for Digital Commerce (ONDC) raises MSME compliance levels, which increases credit availability by 25%. Skill India’s 2 million trained labour, out of which only 5% are skilled in financial tech as per Nasscom, are behind market functions.

The Public Financial Management System (PFMS) converts transactions online, cutting leakages by 30%, according to a 2024 CGA report.

Issues persist. MSMEs, responsible for 40% of construction, have high compliance costs of ₹1–2 lakh a month, constraining access to capital markets, according to a 2024 SIDBI report. Regulatory intricacies, with securitization taking 4–6 years compared to China’s 2, slow upscaling. Infrastructure inadequacies, such as unreliable power, impede digital trading platforms, impacting 20% of NSE operations.

Low financial knowledge, with only 15% of retail investors familiar with PTCs, and low ONDC take-up among MSMEs, hamper inclusivity, according to a 2024 RBI report. Volatility in global trade, affecting 30% of construction inputs, piles on the pressure, according to a 2024 UNCTAD report.

Experts suggest solutions. Subsidies under the Technology Upgradation Scheme can alleviate MSME expenses. Increasing Skill India’s financial training can close literacy gaps. Increasing 5G and power reliability through PM Gati Shakti will stabilize trading platforms.

Public-private collaborations with IITs can create easy-to-use securitization technology. CII-led initiatives can increase ONDC uptake and PTC awareness.

India’s first PTCs on NSE for mortgage-backed securities mark a turning point in housing finance, reflecting an emerging debt market. With continued reforms tackling MSME, regulatory, and infrastructure roadblocks, India can take its securitization ecosystem to scale, driving affordable housing and economic development towards a Viksit Bharat by 2030.