As India’s electric vehicle and electronics industries power industrialization, smart sealants—tunable bonding materials that respond to temperature, stress, or ambient change—are coming to the forefront as key enablers for next-generation use cases.

Given India’s EV market expected to reach 17 million units every year by 2030 and electronics production anticipated to touch USD 500 billion by 2030, these sealants guarantee longevity, heat management, and sustainability in high-performance devices and vehicles.

While Indian producers are pushing innovations to address them, expensive prices and technical complexities might stifle large-scale adoption.

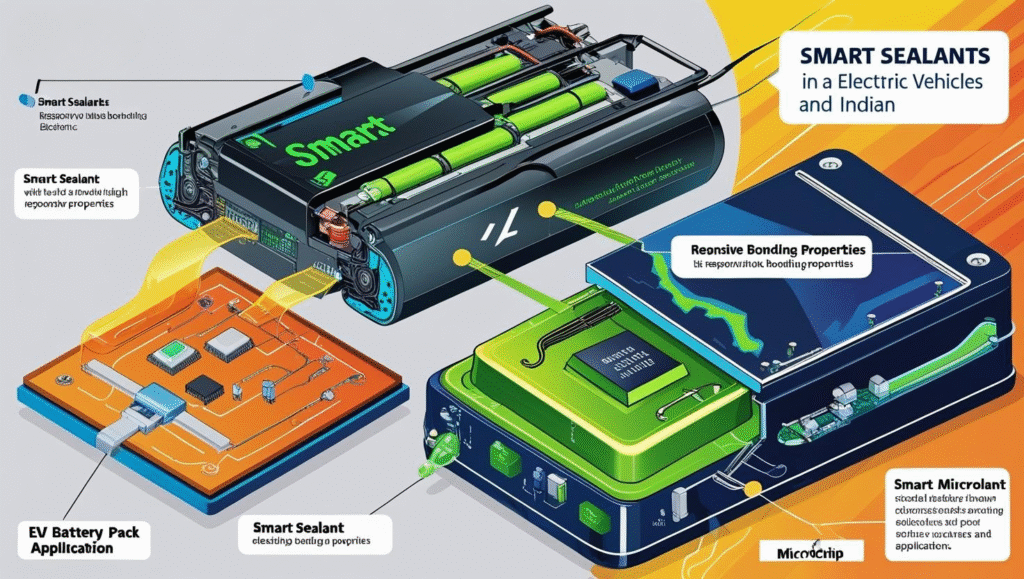

Smart sealants, infused with stimuli-sensitive materials or nanotechnology, move beyond conventional sealing by reacting dynamically to environmental conditions.

In electric vehicles, they control thermal runaway and vibration, whereas in electronics, they provide reliability in small, heat-generating devices. India’s ‘Make in India’ push for self-reliance and a 50% increase in EV production in FY 2023-24 are increasing the demand for these sealants, transforming the USD 3.9 billion adhesives and sealants market.

Temperature-sensitive sealants are critical to battery safety in EVs. EV batteries run above 200°C, necessitating thermal stability.

Polyurethane-based intelligent sealants with phase-change materials (PCMs) trap and release heat, keeping battery temperatures 20°C from optimum levels, according to a 2024 study by IIT Madras. Pidilite Industries’ thermally adaptive sealants, employed in Ola Electric’s Tamil Nadu gigafactory, decrease thermal runaway hazards by 25%.

Stress-responsive sealants with self-healing microcapsules fix micro-cracks due to vibrational stress, increasing battery pack life by 15 years in Mahindra’s electric vehicles, according to a 2023 industry report. They are in line with India’s goal of 30% EV penetration by 2030.

Electronics, with 97% of India’s smartphone manufacturing done locally, require sealants for miniaturized, high-temperature devices. Intelligent sealants with dielectric capabilities, such as Henkel India’s offerings, compensate for 5G chipset temperature surges, providing consistent bonding in power-dense devices up to 100 W/cm².

Graphene-based sealants, led by new companies like NanoMiix, have 30% greater tensile strength and self-heal under mechanical stress to cover flexible displays and wearables.

At a recent exhibition, BASF presented IoT-powered sealants that track moisture and stress in semiconductor packaging, reducing failure rates by 20%, critical to India’s USD 15 billion semiconductor drive by 2030.

Sustainability is a major driver. Bio-based intelligent sealants made from soy and cellulose lower VOC emissions by 70%, meeting the National Green Mission. Asian Paints’ bio-based silicone sealants applied in EV battery enclosures reduce carbon footprints by 15%, according to a 2024 CII report.

IIT Bombay-developed sealants reinforced with nanocellulose enhance durability while being compliant with EU’s REACH norms, aiding electronics exports worth an estimated USD 120 billion by 2030.

Consumer preference, with 60% of urban Indians preferring environment-friendly products according to a 2023 Nielsen survey, further accelerates adoption.

Government policy is speeding up progress.

The Production-Linked Incentive (PLI) scheme with USD 27 billion encourages R&D of advanced materials, whereas the Raising and Accelerating MSME Performance (RAMP) scheme helps small companies, which manufacture 30% of sealants, to adopt smart technology. Rs. 50,000 crore is provided by the National Research Foundation (NRF) for industry-academia partnership, and IITs work on designing adaptive sealants for electric vehicles (EVs). The Skill India Digital Hub has educated 2 million employees in nanotechnology since 2023, backing India’s electronics and EV goals.

Though there are advances, issues persist. Smart sealants are 25-35% more expensive than traditional ones, discouraging MSMEs, with only 10% using them, according to a 2024 SIDBI report. Skill gaps, with only 5% of the labor force educated in responsive material uses, according to Nasscom, stifle innovation. Infrastructure challenges, such as unstable electricity supply in Tier 2 cities, interfere with IoT-integrated production, incurring Rs. 1-2 lakh on SMEs every month, according to sector discussions.

Regulatory lag, with patent approval taking 4-6 years against China’s 2 years, impedes commercialization. ASEAN countries’ global competition through lower costs increases the pressure.

Experts advocate solution-focused measures. Subsidies under the Technology Upgradation Scheme can help soften costs. Skill India’s training in nanotechnology can be expanded to fill skill gaps.

Enhanced 5G connectivity and power reliability, as envisaged under PM Gati Shakti, will enable IoT functionality. Public-private partnerships with ARAI and IITs can expand R&D. Awareness campaigns by CII can create demand in smaller markets.

Intelligent sealants will define India’s EV and electronics future, promising reliability and sustainability.

With a USD 3 billion adhesives market in 2030, hurdling cost, skill, and infrastructure challenges will make India a world leader in adaptive bonding materials, energizing next-generation devices and vehicles towards a cleaner, smarter future.