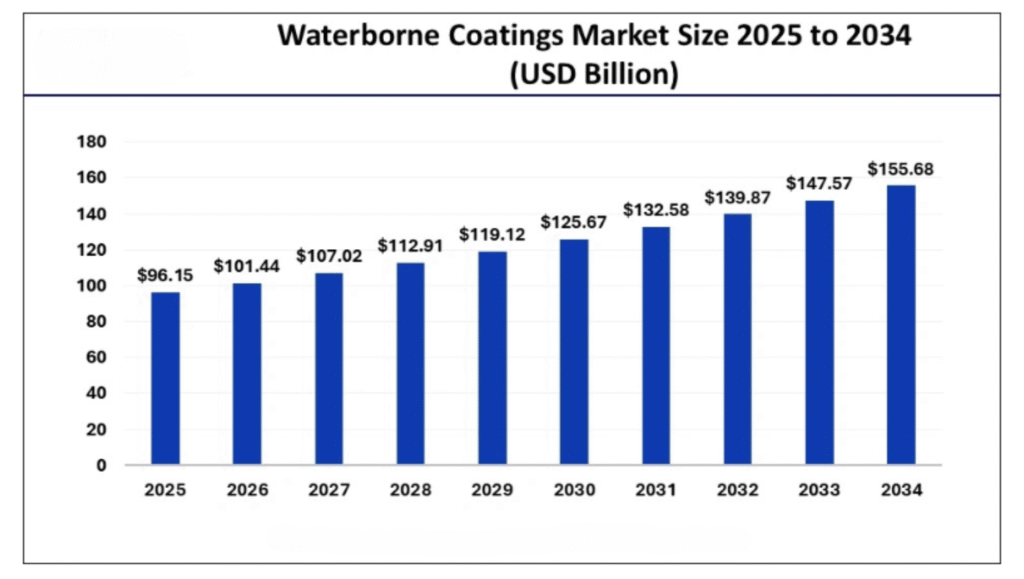

The world waterborne coatings market is on an upward trajectory, expected to climb above USD 119.6 billion by 2032 at a compound annual growth rate (CAGR) of 5.1% from 2024, as per a February 2025 SNS Insider report. With a value of USD 72.3 billion in 2023, the market is fueled by severe environmental regulations, increasing demand for sustainable solutions, and increasing end-use in automotive, construction, and packaging industries.

For India’s USD 3.5 trillion economy, with a ₹70,000 crore coatings market, this growth opens doors for MSMEs to innovate, although regulatory lags, skill deficiencies, and infrastructure shortages create hurdles in realizing a USD 10 billion domestic market by 2030.

Water-based coatings, utilizing water as the solvent, provide low volatile organic compound (VOC) emissions, making them more environment-friendly and healthier for human consumption compared to solvent-based systems.

World Health Organization points out that low-VOC coatings may cut down air pollution health risks by 30% by 2025, as in line with sustainability worldwide, according to SNS Insider. Demand in India for architectural coatings is fueled by initiatives such as PM Gati Shakti, cutting logistics costs by 20%, and Pradhan Mantri Awas Yojana (PMAY), meeting 30% of urban housing needs, as per a 2024 CII report.

The automobile industry, more so electric vehicles (EVs), also drives growth, with India’s EV industry anticipated to be growing at a 36% CAGR until 2030, according to a 2024 FICCI report.

Improved performance through technological upgrades, including bio-based and hybrid waterborne coatings, in abrasion resistance, UV resistance, and durability, according to a 2024 Polaris Market Research report. In India, MSMEs, providing 40% of coating inputs, are embracing these innovations, aided by the ₹50,000 crore Production-Linked Incentive (PLI) scheme, providing 30% of industry output.

Open Network for Digital Commerce (ONDC) expands MSME market access by 25%, according to a 2024 SIDBI report. Nevertheless, high costs of production, by up to 20% compared to solvent-based coatings, and inferior performance in high-humidity environments continue to pose challenges, according to SNS Insider.

Regionally, Asia Pacific tops the list with a 41% market share in 2023, fueled by urbanization of China and India, according to a 2024 Precedence Research report. India’s building industry of USD 200 billion in 2024 is a major driver, with waterborne coatings applied in 60% of new building projects, according to a 2024 CII report. North America and Europe are next, with strict VOC regulations such as REACH and the U.S. EPA’s standards pushing adoption, per a 2024 Acumen Research report.

Challenges persist in India. Regulatory approvals for new formulations take 4–6 years versus China’s 2, delaying market entry, per a 2024 Nasscom report. MSMEs face compliance costs of ₹1–2 lakh monthly, limiting scalability.

Infrastructure gaps, like inconsistent power, disrupt production, affecting 20% of units. Skill gaps, where just 5% of Skill India’s 2 million trained laborers are skilled in higher coating technology, hold back development, according to a 2024 Nasscom report. International trade uncertainty, affecting 30% of Indian chemical imports, puts pressure on the market, according to a 2024 UNCTAD report.

Experts suggest solutions. Technology Upgradation Scheme subsidies can alleviate MSME expense. Increasing Skill India’s coating training can fill the gaps. Improving 5G and power dependability through PM Gati Shakti will stabilize production. Public-private collaborations with IITs can create cost-efficient, environmentally friendly coatings. CII-led initiatives can increase ONDC adoption and industrialization awareness.

The anticipated growth of the waterborne coatings industry to USD 119.6 billion by 2032, according to SNS Insider, emphasizes its role in green industrialization. For India, capitalizing on the opportunity can enhance its coatings community, underpinning economic and infrastructure aspirations.

Overcoming regulatory, talent, and infrastructure hurdles, India can smoothen its future with coatings that are congruent with a Viksit Bharat by 2030.