India’s plastics industry sits at an important inflection point. While the sector has long supplied packaging, consumer goods, automotive components and construction materials, recent shifts in consumption patterns, regulatory pressure on waste management, and rising export demand are reshaping business priorities.

India’s plastics industry sits at an important inflection point. While the sector has long supplied packaging, consumer goods, automotive components and construction materials, recent shifts in consumption patterns, regulatory pressure on waste management, and rising export demand are reshaping business priorities.

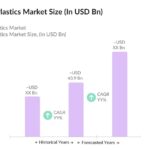

Market size estimates place the industry at roughly US$43–44 billion in 2023, with forecasts pointing to steady expansion over the rest of the decade. Growth drivers are clear: e-commerce and modern retail continue to raise demand for flexible and rigid packaging; the healthcare sector needs single-use and specialized polymer components; and infrastructure and home-building projects absorb significant volumes of pipes, profiles and fittings. These vertical demands create predictable, high-volume opportunities for processors and compounders.

Recycling and circularity have moved from CSR box-checks to commercial imperatives. Extended Producer Responsibility (EPR) rules are forcing brand owners and packagers to account for end-of-life collection and recycling — which in turn raises demand for quality recycled resin (r-PET, r-HDPE, etc.). Companies that can integrate collection, sorting and high-quality recycling will command margin and market-access advantages, especially when selling to buyers demanding higher recycled content.

At the same time, raw material volatility remains the sector’s biggest operational headache. Many feedstocks are tied to global oil/gas prices and regional refinery output; this causes sudden margin squeezes for processors without robust hedging or long-term supply contracts. Import dependence for certain polymers also exposes companies to forex and logistics risk.

For B2B players, the opportunities are concrete. Machinery suppliers will find demand for modern extrusion, compounding and multi-layer film lines as processors upgrade for efficiency and recyclability. Chemical and additive firms that offer compatibilizers, colorants and performance enhancers for recycled blends can capture fast growth. Logistics providers and specialty waste collectors able to guarantee segregated, traceable waste streams will be in demand by brand owners seeking EPR compliance.

Challenges remain. Single-use plastic bans in many states, inconsistent municipal waste segregation, and limited large-scale recycling capacity hamper reliable supply of high-quality recycled feedstock. Many MSMEs also lack the capital to upgrade to low-emission, energy-efficient machinery or to install effluent treatment and waste processing units required by tighter environmental norms.

Looking ahead, the winners will be those who combine scale with sustainability: processors that invest in in-house recycling, adopt process automation, and secure long-term polymer supplies; service providers that build formalized waste-collection networks; and technology providers that reduce processing costs while improving recycled resin quality. With the right public-private push — cluster development, targeted incentives and EPR enforcement — India’s plastics industry can grow responsibly and capture significant export and domestic demand over the next decade.