In its efforts to grow into a $5 trillion economy by 2027, the Micro, Small, and Medium Enterprises (MSME) segment continues to be the growth pillar, accounting for 45% of manufacturing output and 40% of exports and providing a livelihood to more than 111 million workers.

To support this critical sector, cluster-based industrialization has also proved to be a promising approach, which is promoting collaboration, innovation, and competitiveness.

But is this model the secret to unlocking sustainable MSME growth, or does it come up against challenges that may constrict its impact?

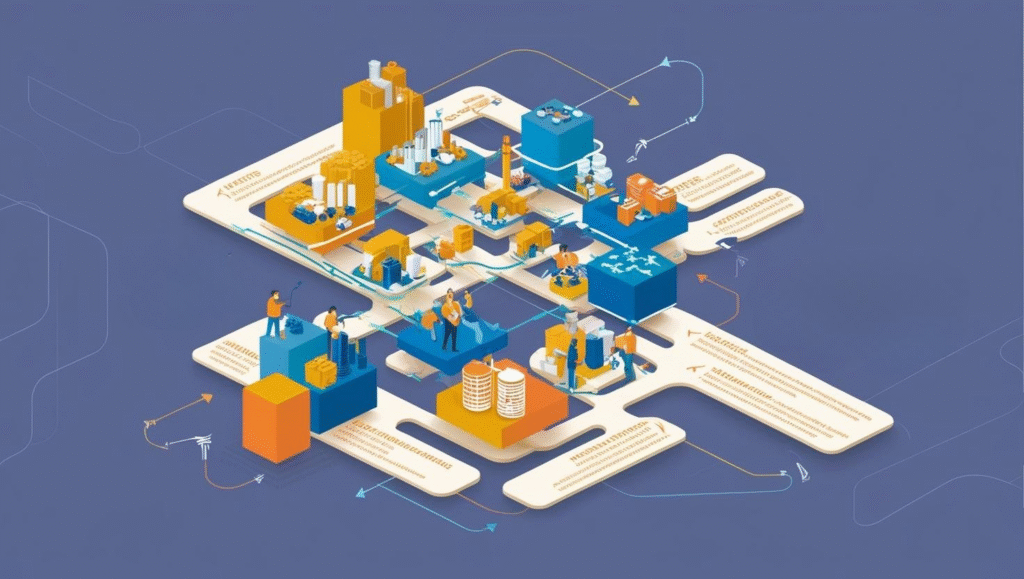

Clustered development is the concentration of enterprises manufacturing similar or complementary goods within a given geographic location that allows them to share infrastructure, resources, and expertise.

The Micro and Small Enterprises-Cluster Development Programme (MSE-CDP) of the Ministry of MSME, initiated in 2006, has facilitated more than 1,000 interventions spread over 29 states, providing financial assistance for diagnostic studies, soft interventions such as training, and hard interventions such as Common Facility Centres (CFCs). Maharashtra has 54 approved cluster projects, with 24 functional CFCs that offer facilities such as R&D centers, testing labs, and effluent treatment plants, enhancing productivity and competitiveness.

Cluster benefits are clear. According to a 2014 research by M.R. Narayana, industrial clusters accounted for 3-8% of the growth in India’s manufacturing sector during 2002-2004, triggered by new small-scale industries, the potential for exports, and resource-based businesses.

Clusters allow MSMEs to tap shared infrastructure at lower costs and enhance economies of scale.

For example, Kerala’s Rubber Cluster at Changanassery and Plywood Manufacturers Cluster in Perumbavoor have used MSE-CDP assistance to improve technology and reach markets, increasing the quality of the product and export ability.

Surat diamond cluster, which cuts 85-90% of the world’s rough diamonds, is a demonstration of how clusters can develop globally competitive systems using skilled human resources and advanced technology.

Clusters also promote innovation and entrepreneurship.

The Entrepreneurship Development Institute of India (EDII) has capacity-built more than 700 officials and rolled out cluster programs in states, enhancing MSME performance by adopting technology and establishing market linkages.

Tamil Nadu has government schemes corresponding to Sustainable Development Goals (SDGs) 8 and 9 that have assisted clusters, enhancing self-employment and economic growth.

A 2023 report emphasized other benefits, such as new business registration, women’s empowerment, and enhanced sales through networking with supporting institutions.

Recent government initiatives highlight the potential of the model.

The Union Budget 2024-25 proposed industrial parks in clusters in 100 cities, integrated with the National Industrial Corridor Development Programme (NICDP), to generate 1 million direct employment opportunities.

The Raising and Accelerating MSME Performance (RAMP) scheme, with Rs. 713 crore for nine states, benefits clusters by minimizing compliance costs and enhancing credit availability.

Vedanta’s announcement of two not-for-profit industrial parks to process aluminum, zinc, and silver also underscores private sector participation in the formation of specialized clusters.

Successes notwithstanding, there are challenges.

Most clusters lack proper infrastructure, which restricts their scalability. A 2012 survey found 17 of 26 MSME clusters inefficient with low turnover even though employment remained high, implying a requirement for improved market linkages and technology upgradation.

Environmental issues like pollution from common effluent treatment plants need more regulation.

The failure of certain Special Economic Zones (SEZs), where tax incentives were more of a priority than infrastructure, can serve as a lesson—more than 60% of SEZs concentrated on IT and not manufacturing, hence constraining wider economic effects. Cluster development is also uneven, with higher-developed regions like Gujarat and Maharashtra receiving more investment owing to superior connectivity and resources, heightening regional disparities.

Access to finance remains a critical hurdle. While the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) and SIDBI’s liquidity facilities of Rs. 31,000 crore have eased credit flow, many MSMEs still face high borrowing costs.

Policy implementation gaps, such as delays in approvals or insufficient capacity-building, can hinder cluster effectiveness.

Maximising cluster-based development’s potential requires India to tackle these challenges. Infrastructure needs to be improved, sustainability promoted, and equitable regional growth ensured. PM Gati Shakti, which connects better, and the Production-Linked Incentive (PLI) scheme can assist clusters by making them part of global value chains.

Digital adoption should also be a priority for policymakers—72% of MSME payments are now digital, offering avenues for expansion via e-commerce and market access.

Cluster-based industrial development provides an impressive template for the growth of MSMEs, encouraging collaboration, innovation, and international competitiveness.

With strategic investment and strong policies, clusters have the potential to propel India’s economic aspirations, but this requires the ability to overcome infrastructure, finance, and environmental issues.

As the country strives towards Viksit Bharat@2047, clusters can quite possibly be the driver of sustainable and inclusive growth—if the implementation is perfect.