India’s logistics and warehousing ecosystem is undergoing a rapid transformation in 2025, positioning itself as a central pillar in the nation’s industrial growth story. In a development that underscores the sector’s growing vitality, logistics and industrial real estate leasing volumes reached record highs this year. Major hubs such as Delhi-NCR, Mumbai, and Pune are leading the expansion as the government’s multimodal infrastructure initiatives accelerate supply chain integration across the country.

According to updated reports, India’s warehouse demand recorded an unprecedented 42 percent year-on-year increase in the first half of 2025, reaching over 32 million square feet of space across major metropolitan regions. The manufacturing sector accounted for nearly half of these leases, underscoring a shift toward domestic production and export-oriented manufacturing. With foreign investments bolstering industrial parks and specialized logistics zones, this surge has created new benchmarks for efficiency, sustainability, and scalability.

Complementing the warehousing boom is India’s push to reduce logistics costs, historically among the highest in the world. Union Transport Minister Nitin Gadkari recently announced that the national logistics cost is expected to drop to around 9 percent of GDP by December 2025—down from 16 percent five years ago. This anticipated reduction aligns India with leading global economies and enhances the country’s competitiveness in international trade. The decline has been attributed to advancements in expressway networks, port modernization, and digital logistics management systems.

The ongoing success of the PM GatiShakti National Master Plan, launched to integrate roads, railways, ports, and airports under a unified framework, has redefined India’s logistics efficiency. Expansion of economic corridors and multimodal connectivity now allows cargo to move faster and more cost-effectively across states. These initiatives are particularly boosting sectors like e-commerce, fast-moving consumer goods (FMCG), automotive manufacturing, and agriculture exports.

At the same time, sustainability is emerging as a major determinant in the new logistics ecosystem. Over 60 percent of newly constructed warehouses in 2025 are classified as Grade A green buildings, featuring energy-efficient systems, solar rooftops, and waste management infrastructure. Several flagship projects have adopted smart monitoring systems and automation to optimize warehouse management. Operators are also investing in renewable energy-powered fleets and electric material handling equipment to reduce carbon footprints.

Manufacturers, retailers, and online platforms have been quick to align with these trends. As e-commerce giants expand their networks deeper into Tier II and Tier III cities, demand for smaller delivery hubs—sometimes referred to as “urban micro-warehouses”—has surged. These facilities enable faster last-mile delivery, meeting consumer expectations for same-day or next-day service. The synergy between digital commerce and physical infrastructure is creating a new layer of growth opportunities in smaller industrial clusters such as Surat, Ludhiana, Coimbatore, and Rajkot.

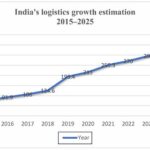

Experts indicate that India’s logistics sector, currently valued at over $300 billion, is on track to grow at a compound annual growth rate (CAGR) of approximately 10 percent through 2026. This pace mirrors the government’s vision of reducing operational inefficiencies and standardizing the movement of goods nationwide. Public–private partnerships, favorable tax reforms, and automation technologies are propelling greater participation from both domestic and international investors.

Even as the sector expands rapidly, challenges remain in the form of skilled labor shortages, fragmented logistics service providers, and uneven infrastructure quality across regions. However, the integration of artificial intelligence (AI) systems into planning and inventory management is helping address these issues. Platforms utilizing predictive analytics now play a crucial role in route optimization, demand forecasting, and load balancing for large-scale logistics providers.

The logistics sector’s impressive momentum is also reshaping employment patterns. Analysts estimate that by early 2026, the industry will create over 2.2 million new jobs in operations, data analytics, transport management, and engineering. New-age training centers, often run jointly by corporate bodies and government programs, have begun preparing India’s workforce for a modern logistics environment aligned with Industry 4.0 standards.

Industrial leasing data from major consultancies points to a strong appetite among global firms for warehousing partnerships in India. Delhi-NCR alone accounted for 11.7 million square feet of new leases during the first three quarters of 2025, leading the national tally. Mumbai, Pune, and Chennai followed closely as manufacturing corridor expansions continued under the Bharatmala and Sagarmala projects. This inflow of investment is strengthening India’s position as a preferred destination for global supply chain diversification.

Policies designed to bridge regional gaps are also central to the logistics revolution. The government’s continued emphasis on integrating rural areas into the value chain through road and digital connectivity has significantly improved access to agricultural markets. From cold storage systems to farm-to-port supply logistics, new solutions are ensuring that India’s agricultural exports and food processing industries have faster, more reliable routes to global consumers.

As 2025 draws to a close, industry observers predict that India’s logistics strength will define its economic resilience. Declining costs, environmentally responsible expansion, and robust investments have turned the sector into a key driver of national competitiveness. The coming months are expected to validate a long-term vision—where efficiency, innovation, and sustainability make India’s logistics landscape one of the most advanced in the emerging world.