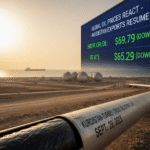

On September 29, 2025, global oil markets experienced a sharp reaction as Iraq’s Kurdistan region resumed crude oil exports to Turkey for the first time in over 2.5 years. Brent crude prices dropped to $69.79 per barrel, while U.S. West Texas Intermediate (WTI) was trading at $65.29 per barrel, reflecting investor apprehension over the sudden increase in supply.

The resumption of exports marks a significant development in the Middle Eastern oil landscape. Analysts point out that Kurdistan’s crude shipments have historically influenced regional oil pricing due to the volume and quality of the exported crude. This return to the market has heightened concerns about a potential oversupply, particularly as it coincides with recent indications from OPEC+ of higher production targets.

Market participants are closely monitoring the situation, as any sustained increase in supply could put further downward pressure on prices. Traders are also factoring in geopolitical stability, pipeline logistics, and storage capacities, all of which can significantly impact the speed and volume of crude entering international markets.

The current trend underscores the sensitivity of global oil prices to both regional export dynamics and broader production policies. As countries and companies adjust to this renewed supply, the market may continue to see short-term volatility while recalibrating to the changing dynamics of crude availability.