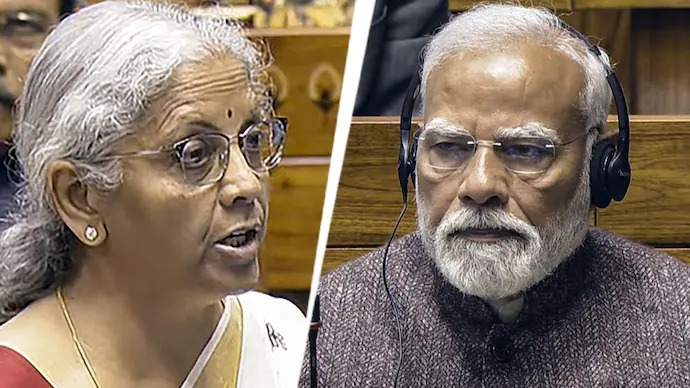

New Delhi: In a decisive move, Prime Minister [PM’s Name] swiftly approved a much-anticipated tax relief measure aimed at easing financial burdens on individuals and businesses. However, the implementation process has been hampered by bureaucratic delays, raising concerns among industry experts and taxpayers.

Quick Decision, Slow Execution

Sources indicate that the Prime Minister wasted no time in greenlighting the tax relief proposal following extensive consultations with economic advisors. The decision was expected to provide immediate relief to middle-class taxpayers and struggling businesses, fostering economic growth and stability.

Despite this proactive approach, the bureaucratic machinery has been slow to translate the policy into actionable steps. Reports suggest that various government departments are still deliberating over procedural details, delaying official notifications and implementation timelines.

Industry Voices Concerns

Business leaders and financial analysts have expressed frustration over the sluggish execution. “The tax relief announcement was a welcome move, but delays in execution dilute its impact. The government must ensure that relief reaches taxpayers without unnecessary red tape,” said an industry expert.

Taxpayers awaiting clarity on how the relief will be applied have also voiced their concerns. “We were expecting immediate benefits, but the lack of concrete guidelines has left us in limbo,” said a senior executive from a leading corporate firm.

Calls for Administrative Reform

The delay has reignited debates on the need for administrative efficiency in policy implementation. Experts suggest that streamlining bureaucratic processes and leveraging digital governance tools could help bridge the gap between policy decisions and execution.

“It is crucial for the government to align administrative efficiency with policy decisions. Swift approvals must be matched by equally swift implementation to maximize economic benefits,” said a policy analyst.

The Road Ahead

As taxpayers await further clarity, pressure is mounting on government departments to expedite the process. The Prime Minister’s prompt action demonstrated political will, but the onus is now on the bureaucracy to deliver results without further delay. Industry stakeholders urge the government to prioritize efficiency, ensuring that relief measures translate into tangible benefits for businesses and individuals alike.

With economic recovery on the line, the coming weeks will be crucial in determining whether the tax relief measure achieves its intended impact or becomes yet another victim of bureaucratic inertia.