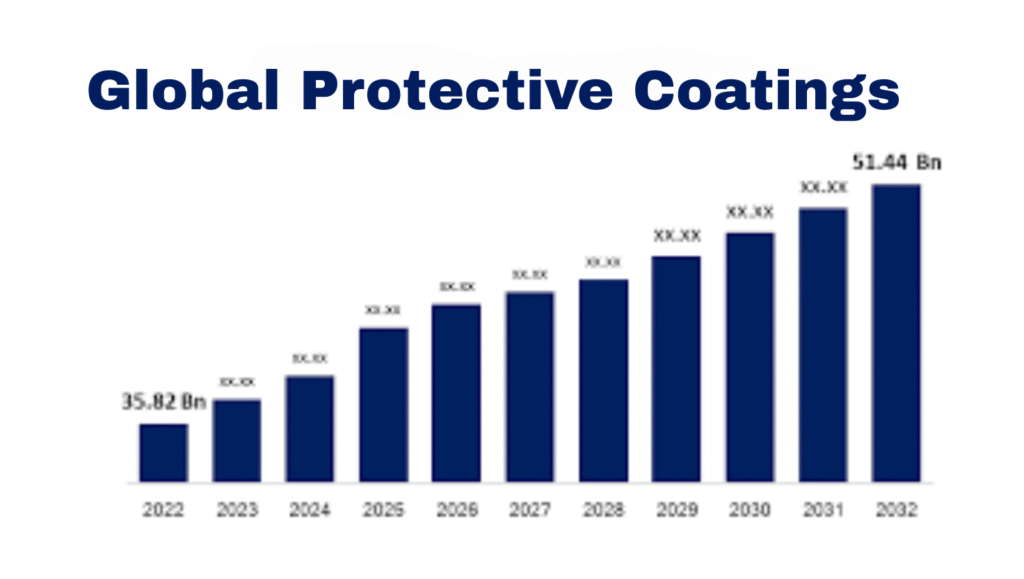

The worldwide protective coatings market is set to experience strong growth, expected to be USD 23.1 billion by 2032, fueled by fast-growing industrialization and infrastructure development, as per a February 5, 2025, SNS Insider report. Worth USD 14.2 billion in 2023, the market will grow at a compound annual growth rate (CAGR) of 5.5% between 2024 and 2032, driven by construction, automotive, aerospace, and marine applications.

For India’s USD 3.5 trillion economy with a ₹70,000 crore coatings industry, this growth presents opportunities for MSMEs to grow, though regulatory hold-ups and skill deficiencies may slow the way to achieving a USD 10 billion domestic market by 2030.

Protective coatings, which play a vital role in protecting surfaces against corrosion, abrasion, and weathering, are gaining traction because of global infrastructure investment, especially in growing economies.

The report spots a 4.5% per annum growth in worldwide construction output till 2025, as per the International Monetary Fund, fueling coatings demand for bridges, structures, and industry plants. In India, the efforts of PM Gati Shakti that reduce logistics costs by 20% and Pradhan Mantri Awas Yojana (PMAY) meeting 30% unsatisfied urban housing requirements drive the sector, as per a 2024 CII report.

Automotive and marine segments, which need long-lasting coatings, add to this, with India’s automotive industry growing at a 7% CAGR until 2030, according to a 2024 FICCI report.

New technologies like low-VOC and eco-friendly coatings are transforming the market. According to the World Health Organization, such coatings have the potential to lower health risks from volatile organic compounds by 30% by 2025, as per stringent global regulations, as stated in SNS Insider. In India, MSMEs, providing 40% of the coating inputs, are embracing sustainable practices, backed by the ₹50,000 crore Production-Linked Incentive (PLI) scheme, responsible for 30% of industry output.

The Open Network for Digital Commerce (ONDC) expands MSME market access by 25%, according to a 2024 SIDBI report, while Skill India’s 2 million skilled workers, although merely 5% with expertise in cutting-edge coating technology, contribute to innovation, according to a 2024 Nasscom report.

allenges persist. Regulatory clearances for novel formulations, taking 4–6 years compared with China’s 2, postpone market entry, according to a 2024 Nasscom report. MSMEs incur compliance costs of ₹1–2 lakh a month, constraining competitiveness. Gaps in infrastructure, such as irregular power, interfere with production, impacting 20% of units.

Volatility in global trade, affecting 30% of India’s chemical imports, contributes to pressure, according to a 2024 UNCTAD report. Low ONDC adoption at 15% of MSMEs enrolled and skill gaps in Tier 2 cities also limit growth.

Solutions are suggested by experts. Subsidies in the Technology Upgradation Scheme can reduce MSME expenses. Scaling up Skill India’s coating training can fill the gaps. Increasing 5G and power reliability through PM Gati Shakti will stabilize production.

Public-private partnerships with IITs can design cost-effective and environment-friendly coatings. CII-led campaigns can increase ONDC adoption and industry awareness.

The future growth of the protective coatings market to USD 23.1 billion by 2032, according to SNS Insider, highlights its invaluable importance in global industrialization.

For India, riding this growth can make its coatings industry stronger, backing infrastructure and economic aspirations. By overcoming regulatory, skill, and infrastructure hurdles, India can color its resilient future, in line with a Viksit Bharat by 2030.