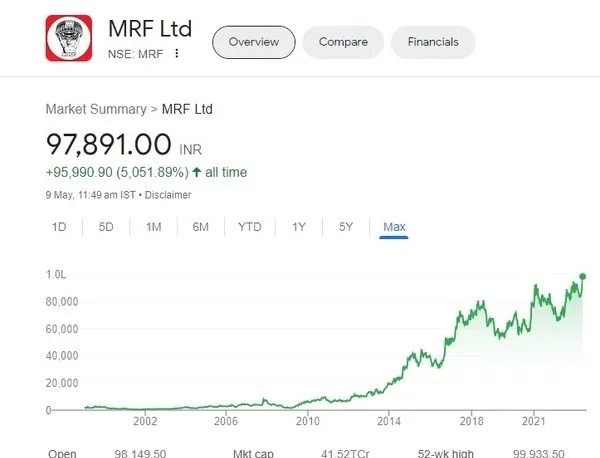

MRF Limited, India’s leading tire manufacturer, has achieved a significant milestone as its stock price surged past the Rs. 1 lakh per share mark. This achievement is a testament to the company’s strong market position, robust financial performance, and investor confidence in its growth potential. MRF has long been synonymous with quality and reliability in the Indian tire industry, and its stock’s remarkable climb showcases its ability to deliver consistent value to shareholders. Let’s delve deeper into the factors contributing to this impressive feat and explore what lies ahead for MRF.

MRF Stock Hits an Impressive Milestone, Reaches Rs. 1 Lakh per Share Mark

The surge in MRF’s stock price reflects the company’s exceptional performance in recent years. MRF has consistently reported strong financial results, driven by factors such as increasing demand for its high-quality tires, effective cost management, and strategic expansion initiatives. The company’s commitment to innovation and continuous improvement has enabled it to maintain its market leadership and deliver value to its shareholders.

MRF’s ascent to the Rs. 1 lakh per share mark is also a reflection of the confidence investors have placed in the company. The tire manufacturer has a long-standing reputation for reliability and excellence, making it a preferred choice among investors seeking stable long-term investments. MRF’s track record of consistent growth, coupled with its ability to adapt to changing market dynamics, has garnered trust from investors and bolstered its stock performance.

Beyond its financial performance, MRF’s strong fundamentals and growth prospects have attracted investors. The company’s focus on research and development, technological advancements, and superior product quality have positioned it as a key player in the domestic and international tire markets. With India’s automotive sector poised for growth, MRF is well-positioned to capitalize on increasing vehicle sales and demand for tires, driving further revenue and profitability.

MRF has consistently pursued expansion and diversification strategies to strengthen its market presence. The company has made significant investments in enhancing its manufacturing capabilities, improving distribution networks, and expanding its product portfolio. By catering to a wide range of customer needs and exploring new market segments, MRF has successfully diversified its revenue streams, reducing its reliance on any single market or product category.

Future Outlook:

As MRF continues its upward trajectory, the company remains optimistic about its future prospects. The Indian economy’s ongoing recovery, supported by increased consumer spending and infrastructure development, bodes well for the automotive industry and, in turn, for MRF. Additionally, MRF’s focus on sustainable practices and green technologies aligns with the evolving market trends, further enhancing its growth potential.

Conclusion:

MRF’s achievement of surpassing the Rs. 1 lakh per share mark is a remarkable feat that underlines the company’s stellar performance, investor confidence, and promising growth prospects. As an industry leader, MRF has demonstrated its ability to adapt, innovate, and deliver superior value to its shareholders. With a strong foundation, robust fundamentals, and a positive market outlook, MRF is poised to maintain its position as a dominant player in the tire industry and create long-term value for its stakeholders.