In a surprising move, the Reserve Bank of India (RBI) has declared the withdrawal of Rs 2000 notes from circulation and has issued a directive urging all individuals and businesses to deposit or exchange these notes by September 30. This decision comes as a significant development in the country’s monetary policy and aims to address concerns related to counterfeit currency and the ease of transactions. Let’s delve into the details of this decision and its potential implications.

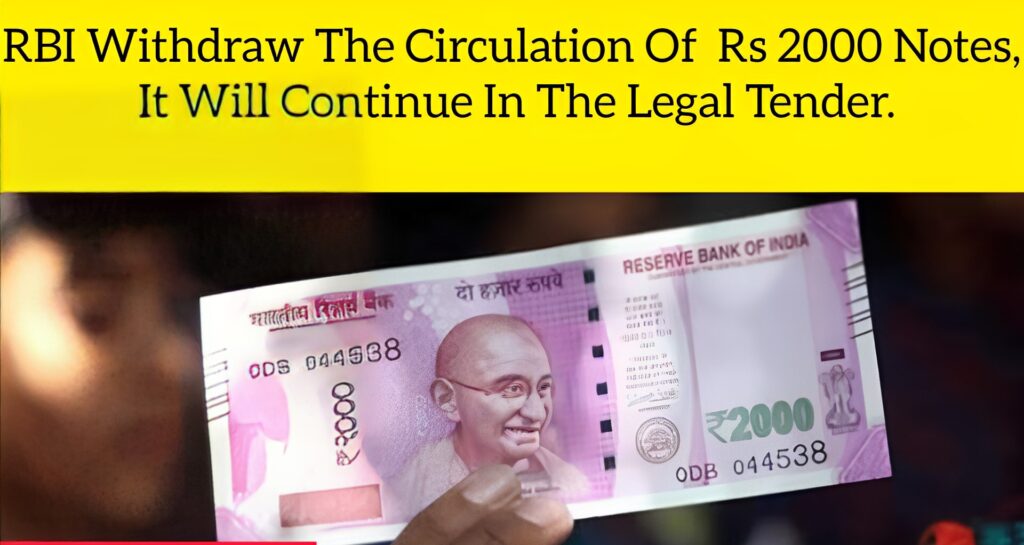

RBI Announces Withdrawal of Rs 2000 Notes

The RBI’s decision to withdraw Rs 2000 notes is driven by several factors. One of the primary concerns is the rising incidence of counterfeit currency, which poses a threat to the integrity of the Indian financial system. The high denomination of the Rs 2000 notes makes them an attractive target for counterfeiters, and their circulation has become a cause for concern. By phasing out these notes, the RBI aims to mitigate the risks associated with counterfeit currency and maintain the stability of the Indian rupee.

Exchange Process and the Deadline

To facilitate the withdrawal process, the RBI has set a deadline of September 30 for the exchange or deposit of Rs 2000 notes. Individuals and businesses can approach their respective banks or authorized financial institutions to exchange these notes for lower denominations or deposit them into their accounts. It is important to note that after the deadline, the Rs 2000 notes will no longer be considered legal tender and cannot be used for transactions.

Impact on the Economy

The decision to withdraw Rs 2000 notes will have both short-term and long-term effects on the Indian economy. In the short term, there might be a temporary disruption in cash transactions as individuals and businesses adjust to the new currency landscape. However, this move is expected to streamline the circulation of currency and encourage the use of lower denomination notes, which will facilitate day-to-day transactions.

Additionally, the withdrawal of Rs 2000 notes may have a positive impact on the overall economy in the long run. With the removal of these high-value notes, the black market and illicit activities that rely on untraceable cash transactions could face significant setbacks. The government’s efforts to promote a digital economy and increase transparency in financial transactions are likely to receive a boost as well.

Promoting Financial Inclusion

Another aspect to consider is the potential impact on financial inclusion. By promoting the use of lower denomination notes, the RBI aims to make transactions more accessible to individuals from all strata of society, including those who rely on cash for their daily transactions. This move aligns with the government’s vision of achieving a less-cash economy and encouraging digital payment methods.

To conclude, the withdrawal of Rs 2000 notes by the RBI marks a significant step in India’s monetary policy and efforts to curb counterfeit currency and promote a transparent financial ecosystem. While this decision may cause temporary inconveniences, it is expected to have long-term benefits for the economy, such as reducing illicit activities and fostering financial inclusion. Individuals and businesses are urged to comply with the RBI’s directive and exchange or deposit their Rs 2000 notes before the September 30 deadline to ensure a smooth transition to the new currency landscape.