The government of Uttar Pradesh has recently given its approval to an insurance scheme aimed at providing support to micro-entrepreneurs in the event of an accident. The scheme, known as the Chief Minister’s Micro Entrepreneur Accident Insurance Scheme, offers a maximum claim of Rs 5 lakh in the case of death or disability of a micro-entrepreneur due to an accident. The claim amount for partial disability will be determined based on the percentage of disability specified in the disability certificate issued by the Chief Medical Officer.

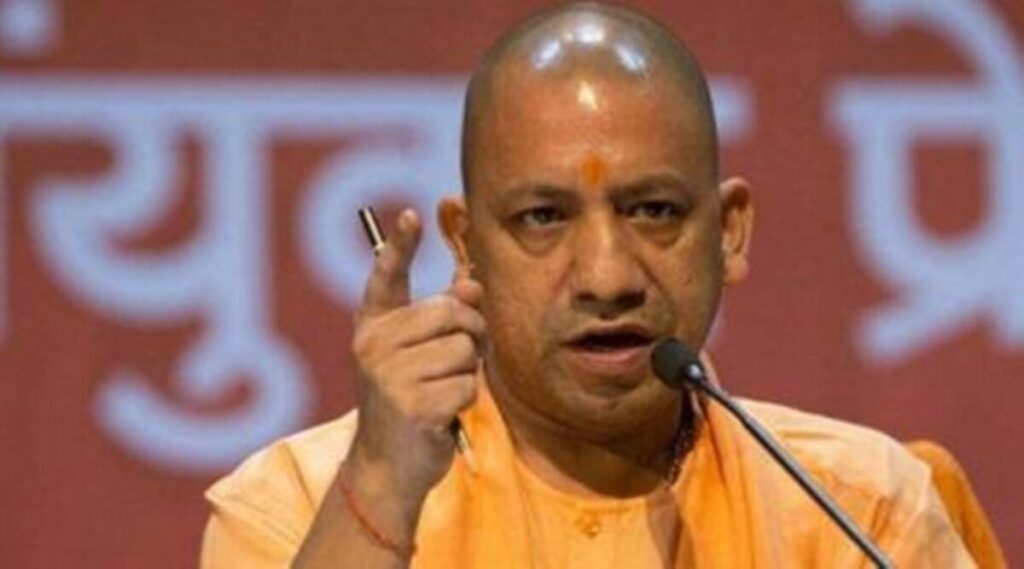

Empowering Micro-Entrepreneurs: Uttar Pradesh Launches Chief Minister’s Micro Entrepreneur Accident Scheme

The Finance Minister of Uttar Pradesh, Suresh Khanna, stated that micro-entrepreneurs between the ages of 18 and 60 can apply for the benefits of the Mukhyamantri Micro Udyami Accident Insurance Scheme. This scheme is particularly beneficial for micro-entrepreneurs who do not qualify for the trader’s accident insurance scheme administered by the GST Department.

It is important to note that Udyam registration is not mandatory to avail of the benefits provided by this insurance scheme. Uttar Pradesh has a substantial number of micro, small, and medium enterprises (MSMEs), with over 90 lakh such businesses in the state. However, only 15.48 lakh MSMEs are registered on the Udyam platform.

According to a statement released by the government, the family of the entrepreneur must apply for the claim online and submit all the necessary forms to the Deputy Commissioner (Industries) of the relevant district in the event of an accident. Once the Deputy Commissioner Industries recommends the claim amount, the insurance payout will be transferred to the nominated heir of the entrepreneur through Direct Benefit Transfer (DBT) within a maximum of one month, following the prescribed procedure at the directorate level.